WD-40 Stock: Still Expensive (NASDAQ:WDFC)

[ad_1]

Kurgu128

WD-40 Enterprise (NASDAQ:WDFC) just introduced bad Q3 earnings and the inventory is buying and selling down in excess of 10% right now. Is it now a cut price?

My evaluation under suggests the remedy is a strong no. I consider traders must nevertheless remain absent from WD-40, as it is still trading at much too loaded a valuation.

Intro to WD-40

WD-40 is dwelling to the iconic WD-40 Multi-use merchandise a lubricant, rust protector, cleaner, degreaser, you name it. For the 1st 40 years, WD-40 Organization bought only 1 product or service. Then starting in the 1990s, the corporation branched out and started buying additional makes and products and solutions such as the 3-in-1 all-purpose lubricant, the Solvol large-duty hand cleaner, and the Place-Shot carpet cleaner.

WD-40 Is A Amazing Enterprise

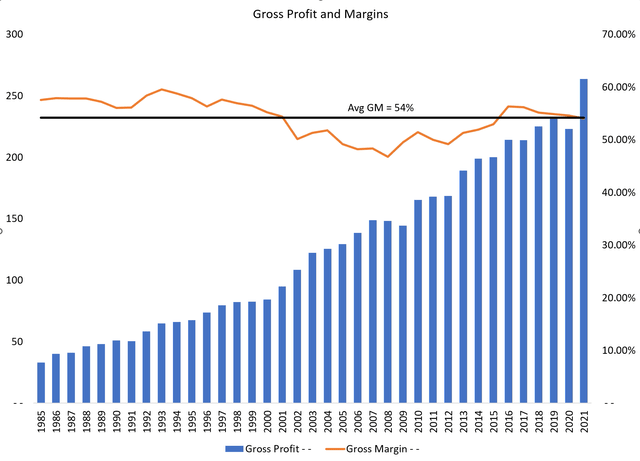

From the economic statements, we can see WD-40 is a excellent company. Revenues have developed at a 6.1% CAGR since 1985, while expansion has been slower in the latest many years, coming in at only 3.8% CAGR for the previous decade. Gross margin averages 54% and is extremely secure (Figure 1).

Figure 1 – WD-40 generates great gross revenue and margins (Author created with info from roic.ai)

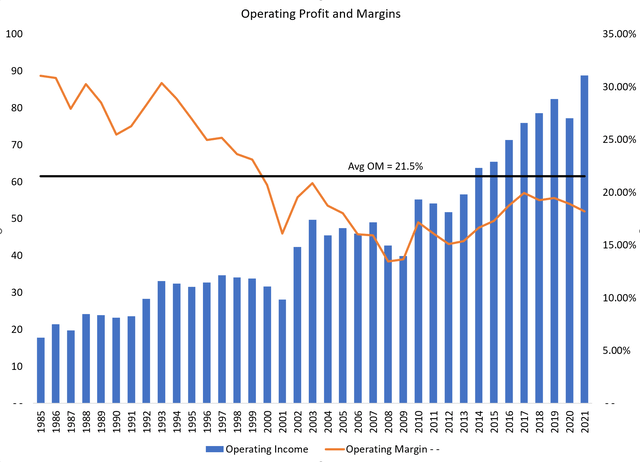

Operating earnings and margins are also superb, with common operating margins of 21.5%, even during recessions and pandemics, WD-40 has not missed a conquer (Figure 2).

Figure 2 – WD-40 Running gains and margins (Writer produced with details from roic.ai)

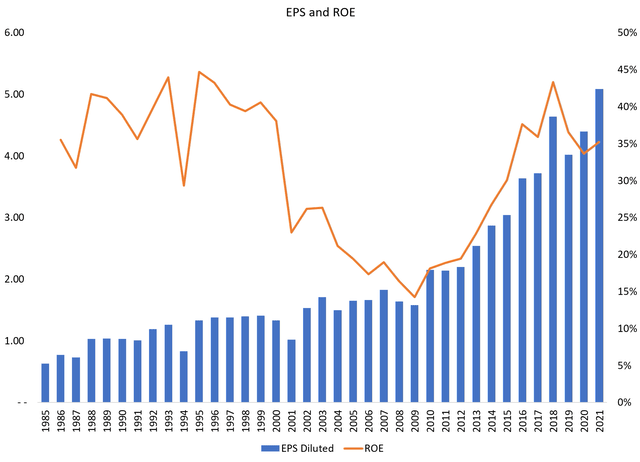

This has led to fantastic ROE and EPS functionality, with EPS compounding at a 6% CAGR because 1985 (Determine 3).

Determine 3 – WD-40 ROE and EPS (Writer made with details from roic.ai)

What is Not To Like? The Valuation

We’ve established that WD-40 is a amazing minor small business that continually generates income no issue the natural environment. So what is actually the situation?

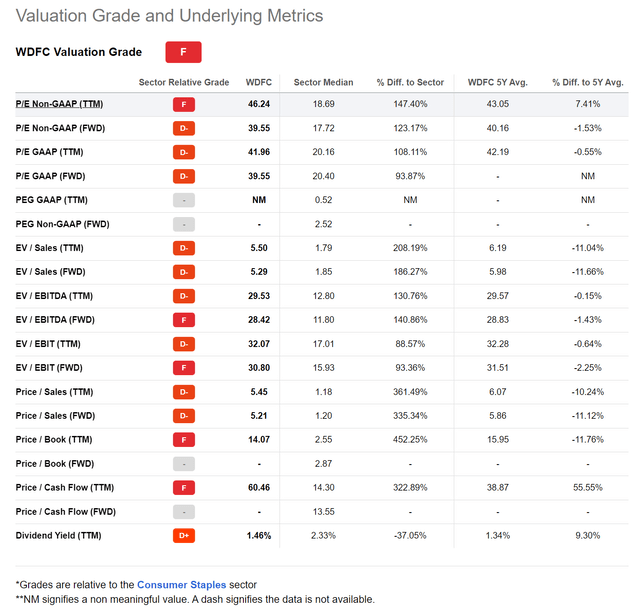

The challenge is that the amazing business enterprise is more than priced in, with the stock buying and selling at a 46x trailing P/E, more than 2 times the sector average of 19x. WD-40 trades at 14x P/B, this means even if it generates an ROE of 35% like in 2021, your financial commitment dollar is only earning $.025, even worse than 1-year treasury bonds earning above 3%! (Determine 4)

Determine 4 – Valuation quality for WD-40 (In search of Alpha)

WD-40 is a typical case of a fantastic enterprise buying and selling at a not-so-wonderful value.

Newest Quarterly Highlights Concerns

WD-40 just unveiled its Q3/22 earnings yesterday, and the benefits emphasize the fact that the firm is priced to perfection.

Product sales fell 9% YoY to $124 million and EPS was $1.07, lacking consensus estimates by $.20. Most importantly, gross margins contracted 540 bps YoY to 47.7%. If this persists, this will be the least expensive gross margin considering that the Good Money Crisis in 2008 when gross margin was 46.8%. The principal problem was soaring inflation in enter charges, a common concept that we believe that will strike all providers in 2022.

We have no doubt the corporation strategically raises price ranges and at some point the enterprise will recover to the normal gross margin stage of 54%. Nonetheless, the stock reaction just displays how small valuation aid there is at 14x P/B and 46x P/E.

Summary

While WD-40 is a wonderful enterprise that delivers income as a result of all market place environments, traders have bid up the shares to absurd valuation amounts that are prone to the slightest hiccup, like this latest Q3/22 earnings. Although shares are down above 10%, we think they are nevertheless grossly overvalued and would advocate traders stay absent.

[ad_2]

Resource url