[ad_1]

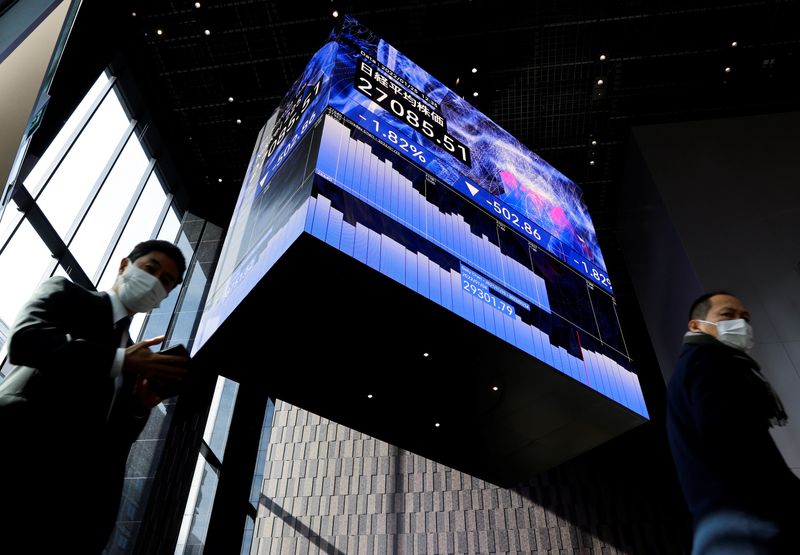

© Reuters. FILE Photo: Gentlemen putting on protective deal with masks walk less than an electronic board displaying Japan’s Nikkei share normal inside a conference corridor, amid the coronavirus disease (COVID-19) pandemic, in Tokyo, Japan January 25, 2022. REUTERS/Issei Kato

By Wayne Cole

SYDNEY (Reuters) – Asian shares bought off to a sluggish start out on Tuesday immediately after a rally on Wall Avenue was soured by an early slide in U.S. stock futures, even though the euro was near a single-thirty day period highs as odds narrowed on a July price increase by the ECB.

Right after ending Monday firmer, Nasdaq futures misplaced 1.3% with traders blaming an earnings warning from Snap (NYSE:) which saw shares in the Snapchat proprietor tumble 28%.

also misplaced .6%, surrendering some of Monday’s 1.8% bounce.

MSCI’s broadest index of Asia-Pacific shares exterior Japan was still left pretty much flat as a outcome, even though dipped .1%.

Markets have taken some ease and comfort from U.S. President Joe Biden’s comment that he was looking at easing sanctions on China, and from Beijing’s ongoing guarantees of stimulus.

Regretably, China’s zero-COVID policy, with attendant lockdowns, has by now carried out significant financial damage.

“Following disappointing April exercise knowledge, we have downgraded our China GDP (gross domestic products) forecast once again and now glimpse for 2Q GDP to contract 5.4% annualised, previously ‒1.5%,” warned analysts at JPMorgan (NYSE:).

“Our 2Q world wide progress forecast stands at just .6% annualised fee, quickly the weakest quarter due to the fact the world wide monetary disaster exterior of 2020.”

Early surveys of European and U.S. producing acquiring managers for May possibly are due out later on Tuesday and could exhibit some slowing in what has been a resilient sector of the international economic climate.

Analysts have also been trimming forecasts for the United States offered the Federal Reserve looks particular to hike interest premiums by a full proportion position over the next two months.

The hawkish information is most likely to be pushed property this week by a host of Fed speakers and minutes of the very last coverage conference because of on Wednesday.

However the European Central Lender is also turning extra hawkish, with President Christine Lagarde astonishing numerous by opening the door for a level rise as early as July.

That noticed the euro up at $1.0685, possessing bounced 1.2% right away in its best session due to the fact early March. It now faces rigid chart resistance all over $1.0756.

The dollar also retreated compared to sterling and a vary of currencies, getting the down .9% right away and back to 102.100.

In the meantime the euro jumped sharply to 136.56 Japanese yen, even though the greenback held steady at 127.77 yen.

The pullback in the dollar served gold get back some ground to $1,853 an ounce. [GOL/]

Oil charges were being caught involving worries about a feasible world downturn and the prospect of greater gas demand from the U.S. summertime driving period and Shanghai’s ideas to reopen right after a two-month coronavirus lockdown. [O/R]

was down 59 cents at $109.70, even though lost 60 cents to $112.82.

(This story corrects to clear away para 3 point out of Fb (NASDAQ:) and Twitter (NYSE:) reporting following week.)

[ad_2]

Resource link

More Stories

The Ultimate Financial Education Guide for All Ages

Financial Education Secrets to Master Your Money

Essential Steps for Financial Education Success