Earnings Beat: Phillips Edison & Company, Inc. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Models

[ad_1]

Phillips Edison & Enterprise, Inc. (NASDAQ:PECO) defied analyst predictions to release its quarterly outcomes, which were forward of market place expectations. It was all round a favourable result, with revenues beating anticipations by 2.7% to hit US$143m. Phillips Edison also claimed a statutory revenue of US$.12, which was an outstanding 39% over what the analysts experienced forecast. Following the end result, the analysts have up to date their earnings model, and it would be fantastic to know irrespective of whether they consider you can find been a sturdy modify in the company’s prospects, or if it is really enterprise as typical. We believed visitors would obtain it interesting to see the analysts newest (statutory) submit-earnings forecasts for future 12 months.

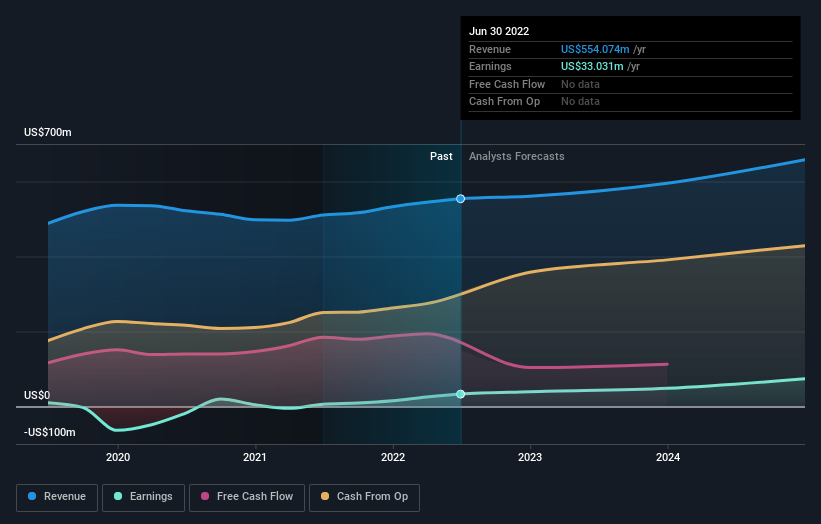

Using into account the latest effects, Phillips Edison’s five analysts currently hope revenues in 2022 to be US$560.8m, approximately in line with the very last 12 months. For every-share earnings are envisioned to soar 24% to US$.35. In the guide-up to this report, the analysts experienced been modelling revenues of US$560.8m and earnings per share (EPS) of US$.34 in 2022. So the consensus seems to have turn out to be fairly far more optimistic on Phillips Edison’s earnings opportunity following these results.

The consensus price target was unchanged at US$36.50, implying that the enhanced earnings outlook is not predicted to have a extended term affect on price development for shareholders. Fixating on a one rate goal can be unwise however, given that the consensus target is effectively the normal of analyst cost targets. As a outcome, some traders like to appear at the range of estimates to see if there are any diverging views on the firm’s valuation. The most optimistic Phillips Edison analyst has a price tag goal of US$46.00 for every share, when the most pessimistic values it at US$31.00. As you can see, analysts are not all in settlement on the stock’s potential, but the array of estimates is however moderately slim, which could recommend that the consequence is not thoroughly unpredictable.

A different way we can perspective these estimates is in the context of the bigger photo, these as how the forecasts stack up versus past efficiency, and regardless of whether forecasts are much more or a lot less bullish relative to other organizations in the market. It’s fairly very clear that there is an expectation that Phillips Edison’s revenue growth will sluggish down significantly, with revenues to the stop of 2022 expected to screen 2.5% growth on an annualised foundation. This is in contrast to a historic expansion amount of 11% in excess of the past five a long time. By way of comparison, the other businesses in this sector with analyst protection are forecast to expand their income at 7.% for each yr. So it is really rather very clear that, while earnings progress is expected to gradual down, the wider industry is also predicted to grow quicker than Phillips Edison.

The Bottom Line

The most critical detail listed here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism in the direction of Phillips Edison pursuing these benefits. Thankfully, the analysts also reconfirmed their income estimates, suggesting sales are monitoring in line with expectations – while our info does advise that Phillips Edison’s revenues are expected to conduct worse than the broader field. There was no authentic modify to the consensus selling price goal, suggesting that the intrinsic worth of the enterprise has not been through any important improvements with the latest estimates.

Trying to keep that in intellect, we even now assume that the extended time period trajectory of the business enterprise is a great deal a lot more important for buyers to think about. We have forecasts for Phillips Edison going out to 2024, and you can see them totally free on our system in this article.

Even so, be informed that Phillips Edison is exhibiting 3 warning signs in our financial investment analysis , and 1 of those will not sit way too very well with us…

Have suggestions on this post? Involved about the material? Get in contact with us specifically. Alternatively, e mail editorial-staff (at) simplywallst.com.

This write-up by Only Wall St is general in mother nature. We provide commentary centered on historic details and analyst forecasts only making use of an unbiased methodology and our article content are not intended to be economical tips. It does not represent a suggestion to obtain or provide any stock, and does not take account of your objectives, or your financial situation. We intention to deliver you prolonged-term focused examination driven by elementary knowledge. Be aware that our analysis may not aspect in the most recent rate-sensitive enterprise announcements or qualitative material. Merely Wall St has no place in any shares stated.

The sights and viewpoints expressed herein are the sights and opinions of the writer and do not necessarily mirror people of Nasdaq, Inc.

[ad_2]

Source url