Are we in Schrodinger’s Recession?

[ad_1]

IngaNielsen/iStock through Getty Photographs

Pop society fan or not, the quantum mechanics principle of Schrodinger’s Cat has become commonplace thanks to “The Huge Bang Theory” for a shortcut for the possibility of two states of existence at after.

Like the cat in the experiment, the U.S. economy may perhaps have this duality. It might be in a economic downturn suitable now, or not at all until finally we really observe one.

From an fairness viewpoint, the broader current market (SP500) (NYSEARCA:SPY), development (QQQ) (IWF) and modest-caps (IWM) are all in bear territory.

And the Treasury market (TBT) (TLT) (SHY) is pricing in a Fed overshoot with the latest tumble in yields and breakeven expectations.

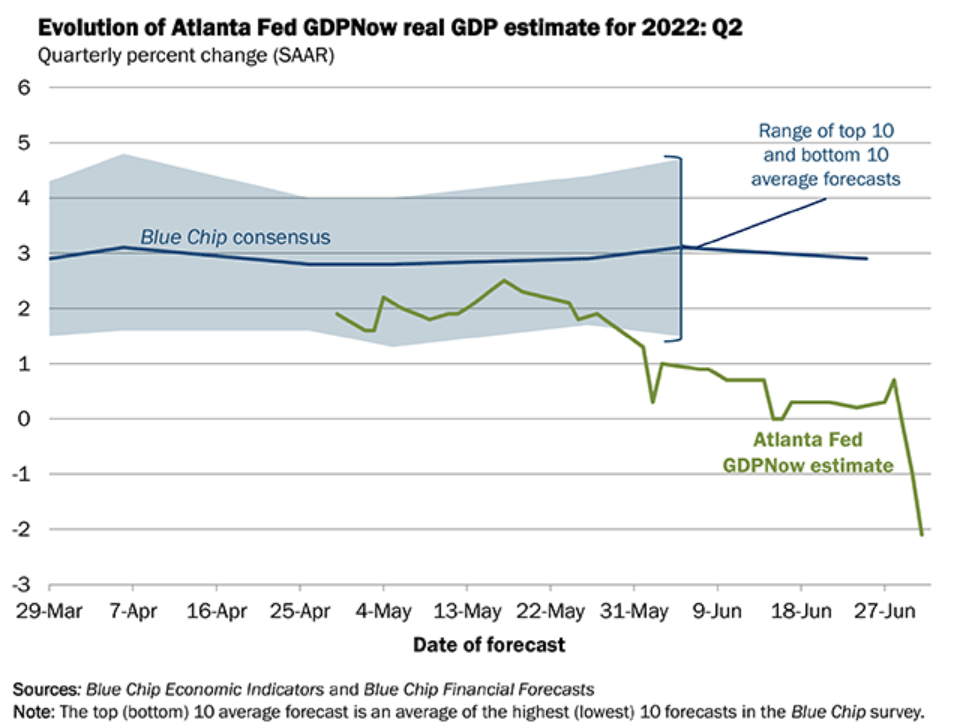

The Atlanta Fed’s GDPNow forecast has Q2 GDP at -2.1% subsequent Friday’s manufacturing details.

“After this morning’s Manufacturing ISM Report On Enterprise from the Institute for Provide Administration and the construction report from the US Census Bureau, the nowcasts of next-quarter actual personal intake expenditures expansion and genuine gross personal domestic financial investment progress reduced from 1.7 p.c and -13.2 percent, respectively, to .8 percent and -15.2 p.c, respectively,” the hottest report reported.

Two consecutive quarters of contraction is the regular definition of a recession. But it is really the NBER’s definition of declining financial action that is the arbiter.

“The NBER’s definition emphasizes that a economic downturn includes a sizeable decline in financial exercise that is spread throughout the economic system and lasts much more than a number of months,” it says. “In our interpretation of this definition, we address the three criteria – depth, diffusion, and length – as fairly interchangeable.”

“That is, though each individual criterion requirements to be met independently to some diploma, serious conditions unveiled by 1 criterion may perhaps partially offset weaker indications from yet another,” it extra.

“For case in point, in the scenario of the February 2020 peak in financial action, the committee concluded that the subsequent fall in activity experienced been so good and so broadly subtle throughout the financial state that, even if it proved to be fairly short, the downturn should really be labeled as a economic downturn.”

“The NBER’s definition of recessions is intentionally vague,” Pantheon Macro Chief Economist Ian Shepherdson claimed. But “they typically demand a drop in payrolls to validate the message from other knowledge.”

“Payrolls rose by an regular of about 440K per thirty day period across the very first fifty percent of the yr, a speed far more regular with a raging increase than economic downturn, while substantially of the enhance presumably displays continued submit-Covid capture-up choosing.”

Receiving back to shares, Jim Paulsen, strategist at the Leuthold Group, observed that the New York Fed’s recession product, which uses the 10-year/3-month Treasury yield curve to forecast a recession in 12 months is only at 4.1%.

“Even though most models advise the possibility of economic downturn in the following twelve months is minimum, fears of a economic downturn are terribly large,” Paulson wrote. “For that reason, a lot of consider bottom-up Wall Street analysts will quickly be pressured to considerably reduced most companies’ earnings estimates”

“Nonetheless, if historical past is any guidebook, until the NY Fed’s recession design rises to at the very least 20%, most likely EPS fundamentals will proceed to be a enjoyable shock?”

See how in genuine phrases, stock are hunting at Civil War general performance.

[ad_2]

Source backlink